GR Mitchell Helps 128 Year Old Philadelphia Building Revive Its Exterior

May 31, 2022

GR MITCHELL’S PAINT DONATION HELPS LOCAL SCHOOLS BRIGHTEN UP THE HALLWAYS

August 24, 2022Finally, Some Good News about Building Material Prices

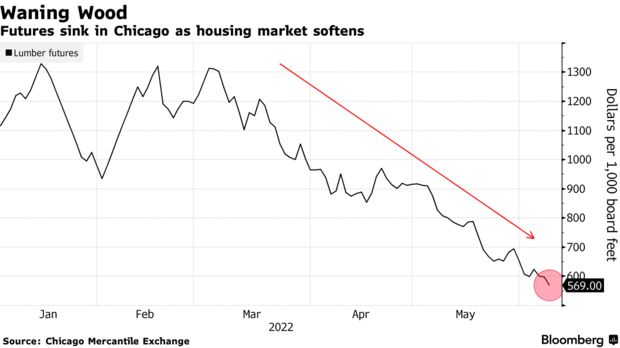

Been waiting for some relief from the surging price of lumber? Well, it’s here. With futures hitting $568.30 (at the close of 6/09/22), lumber prices are at their lowest since September of last year. This represents about a 50% drop from the start of this year.

Understanding Futures

Fan of gambling? When suppliers purchase on the futures market, that’s the best way to describe the process. Futures prices are theoretical numbers. It’s a guess about where the actual market will be. When it comes to commodity goods, like lumber, news reports typically talk about the futures market. But it’s important to understand that a ‘futures price’ doesn’t always mean the actual price will follow in-line. For example, lumber bought on the futures market could ultimately have a lower actual market value. Meaning; The supplier who purchased the lumber now owns inventory it must sell at a loss, based on the current market. The further ahead a supplier purchases on the futures market, the bigger the risk that actuals will not be at parity. Interested in seeing futures? View current lumber futures.

Today's Future Price

$568

As of Close June 9, 2022

The Peak Price

$1601

Future's Market Topped Out May 2021

The Drop

50%

Rough Change This Year

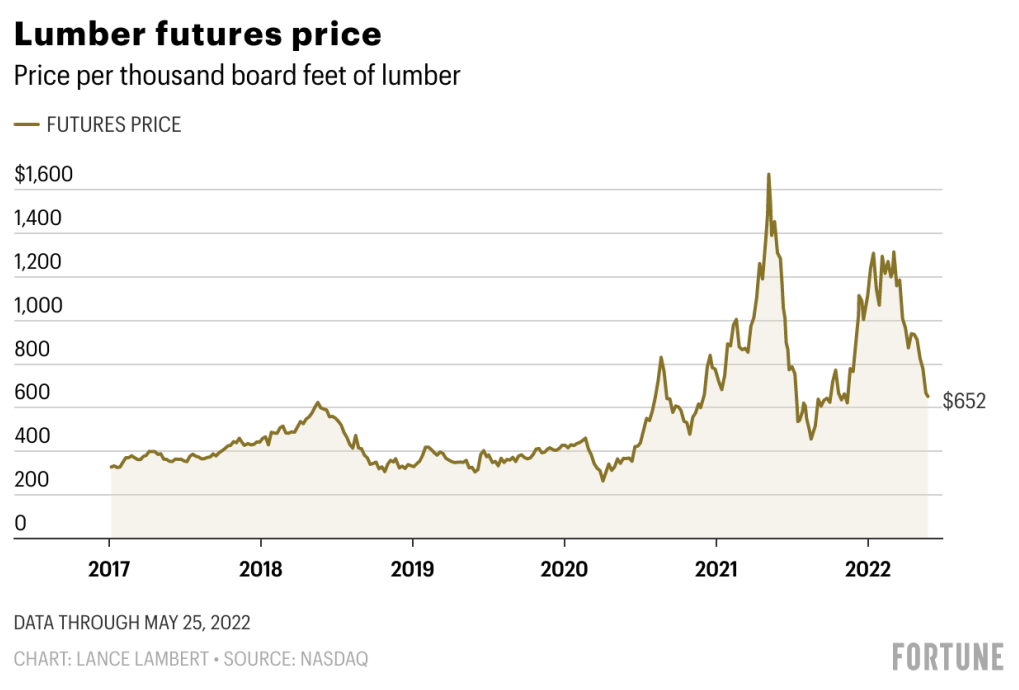

Volatile Years for Lumber

If you’re in construction, you know. Anticipating the lumber market over the past 2 years has been next to impossible. Like herding cats. This likely left you (really your revenue) vulnerable. Did your original bid match the current market price? Were you able to include escalation clauses in your estimates? Did you maintain profitability amid volatility?The market experienced two MAJOR spikes where you may have really felt the pressure:

- Spring of 2020 was dominated by one thought: COVID. As the world slowed and many industries shut down, and lumber mills chose to do the same. They did not anticipate the remodeling explosion and housing boom that unfolded, leading to demand totally dry-up. Prices surged over the next 12 months, reaching an all-time high of $1,601 by May 2021.

- Prices settled by August 2021, only to skyrocket again as we entered 2022. Transportation and labor issues were major influencers in this drive. By March, the futures market hit $1,480.

The Descent

Of course, there’s typical seasonality that shows some relief in lumber pricing each year, but there’s other factors driving the velocity of this drop.

Slowing demand has created a typical supply/demand price decline. According to the NAHB, the average price of a new single-family home as increased over $18,000 in just one year’s time. Predictably, high housing prices, combined with fluctuating mortgage rates, have contributed to a cooled housing market. Fewer homes being built = less pressure on lumber supply.

Transportation bottlenecks loosening aided by calm spring weather to the North (torrential downpours and mudslides have previously impacted supply and in-turn prices) have helped to improve the dependability of deliveries and further increase inventories across the US. And, while mill curtailments are slowing production currently, lack of supply is no longer a concern.

What to Expect Next

Making predictions about the lumber market has been extremely challenging lately, but barring any impact from major tropical storms we believe you’re safe from price increases for the time being. Over the next 3 to 4 weeks, we anticipate that lumber will continue to drift down, but at a much slower pace. The big movement is likely over.